Get $400 when you open a new eligible Wells Fargo checking account with a minimum opening deposit of $25. Within 150 days of account opening, you must have a total of at least $3,000 each month in qualifying direct deposits for three consecutive months. Get $250 when you open a new eligible Wells Fargo savings account in branch with a minimum opening deposit of $25. Deposit at least $15,000 in new money within 10 days of account opening. Maintain a minimum daily balance of at least $15,000 for 90 days from account opening.

Bonus will be deposited to your new accounts within 45 days after meeting all offer requirements. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes.

For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience.

For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. TD Bank offers two different bonuses for new checking account customers. The first is a $300 bonus for a brand new TD Beyond Checking account. New clients qualify for the bonus after making $2,500 in direct deposits within the first 60 days of opening the account. There is no minimum deposit to open the account, but it comes with a hefty $25 monthly fee. This fee is waived if the customer maintains a $2,500 minimum daily balance.

The account pays interest, and there are no charges for non-TD automated teller machine transactions. Open an Everyday Checking account online or bring a bonus offer code to a participating Wells Fargo branch and open an eligible consumer checking account. To qualify for the bonus, within 150 days of account opening, receive a cumulative monthly total of $3,000 or more in qualifying direct deposits each month to the checking account opened for this bonus offer for three consecutive months. Open an eligible consumer checking account online or bring a bonus offer code to a participating Wells Fargo branch.

Within 90 days of account opening, receive a total of $4,000 or more in qualifying direct deposits to your new checking account. After the initial 90 days of account opening, your bonus will be paid within the next 30 days if you have met all offer requirements. Since these accounts are offered to consumers who have been denied a bank account, do your research beforehand. Some may come with restrictions like higher monthly fees and/or minimum balance requirements. The good news, however, is that they allow to to rebuild your banking history over time so that you can later qualify for a standard checking or savings account.

Open a new eligible Wells Fargo savings account in branch with a minimum opening deposit of $25. Bonus will be deposited to your new savings account within 45 days after meeting all offer requirements. Wells Fargo's Way2Save savings account has a $25 initial deposit requirement and has a $5 monthly service fee.

The fee can be avoided by maintaining a $300 daily balance. You can also avoid the fee by setting up a monthly transfer to your savings or enrolling in a program that moves a $1 from your checking to your savings each time you pay a bill or swipe your debit card. The account has an APY much lower than the national average.

Once your loan funds are disbursed, you can make payments by signing in online. You can also set up automatic payments from your checking or savings account by visiting the Wells Fargo online platform. Alternatively, payments may be made in person at a local Wells Fargo branch, by phone or by mailing a personal check, cashier's check or money order. Banks and other financial institutions earn money from many sources. One such source is the revenue they receive from—on-average—over 30 potential fees on checking accounts, according to The Wall Street Journal. These fees include monthly maintenance, non-sufficient funds charges, overdraft fees, paper statement charges, and dormant account fees among others.

However, a cash back promotion can be a win-win for banks and consumers alike, as long as the latter remain aware of the pitfalls that could threaten their deposits. Wells Fargo offers consumers a range of banking products, including personal loans. Loans are available between $3,000 and $100,000, and terms may range from one to seven years depending on the loan amount. Borrowers don't have to be current Wells Fargo customers to get a personal loan, but existing account holders can benefit from a more streamlined application process and lower annual percentage rates .

Open a new Everyday Checking account with a minimum opening deposit of $25. Set up and receive a monthly cumulative total of $3,000 in qualifying direct deposits into your new account for 3 consecutive months. Your $400 bonus will be deposited to your account within 45 days after completing requirements.

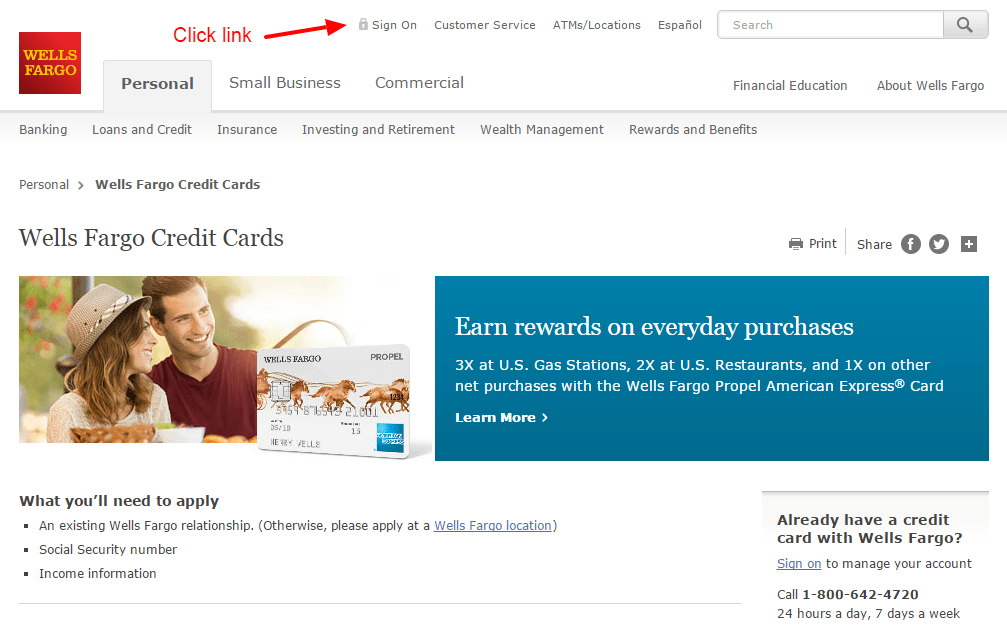

This is an exclusive, online-only offer and is not valid for branch or phone account opens. Founded in 1852 as a bank and express delivery company, Wells Fargo offers a full range of banking services, including checking accounts, savings accounts, CDs, money market accounts, mortgages and other loans. Brand new HSBC customers can choose from two different checking account offers. The first promises $475 with the opening of an HSBC Premier Checking account.

In order to quality, customers must make direct deposits of at least $5,000 into the account each month for three full months from the second month that the account is open. The second offer is for up to $350 with the Advance Checking account. This bonus is earned over 12 months and requires setting up direct deposit.

You'll earn 2% cash back on the amount of your direct deposit each month, up to $30 per month. This offer is good for the first 12 months of account opening and is capped at $350 for the year. The bank also offers a $200 bonus for customers who open a new savings account with a deposit of $15,000 or more within 20 business days. Customers must maintain that balance for at least 90 days. A $5 per month fee applies unless customers maintain at least $300 per day in the account.

If this isn't the account for you, you can earn $150 by opening a Convenience Checking account. Like the Beyond Checking account, there is no minimum deposit requirement. There is a monthly $15 fee, which is waived if the customer maintains at least $100 throughout the month. In order to get the signup bonus, customers must have a minimum of $500 in direct deposits within 60 days.

Open a new Everyday Checking account online or in branch. Receive a total of $1,000 or more in qualifying direct deposits to the new checking account within 90 calendar days from account opening . $200 bonus will be deposited to the account within 30 days after the qualification period. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account.

Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's messaging and data rates may apply.

Until April 7, 2020, new Huntington Bank customers can qualify for one of two different bonuses after opening up a new checking account. Those who open the Asterisk-Free Checking account may receive a $150 cash bonus. There is no minimum balance requirement and this account comes with no monthly maintenance fees.

For the $200 cash bonus, customers must open the Huntington 5 Interest Checking account. Customers who open a Fifth Third Bank Essential checking account until April 30, 2020 receive a $250 bonus. In order to qualify, customers must reach a balance of $500 within 45 days of opening account and maintain that balance for 60 days thereafter. This offer is only available to brand new customers, and cannot be redeemed by existing Fifth Third clients.

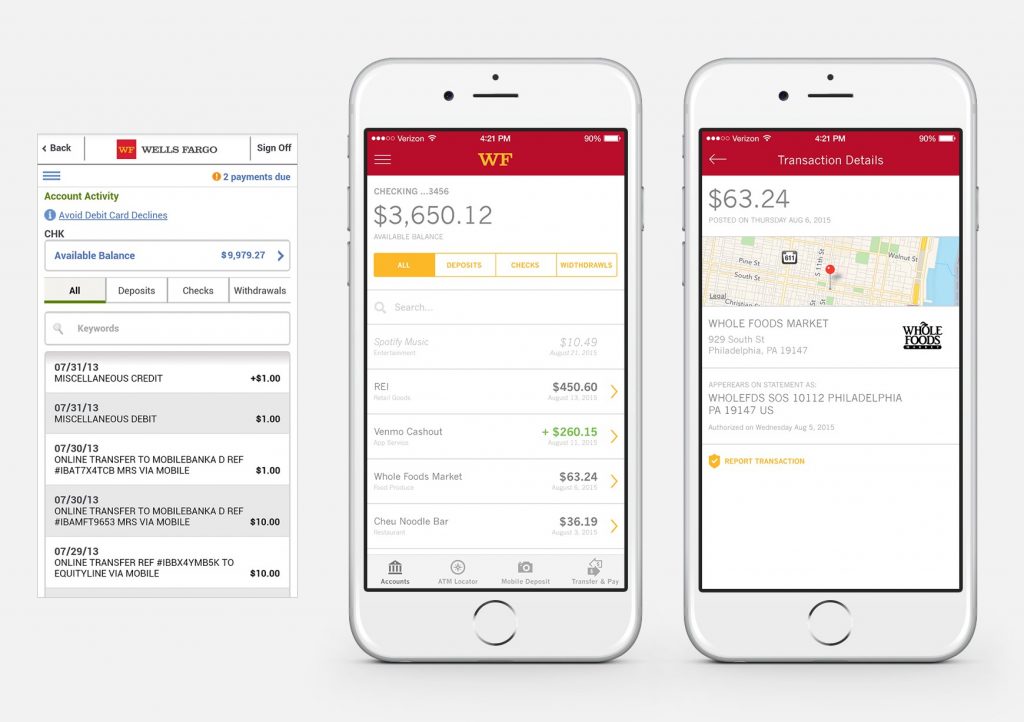

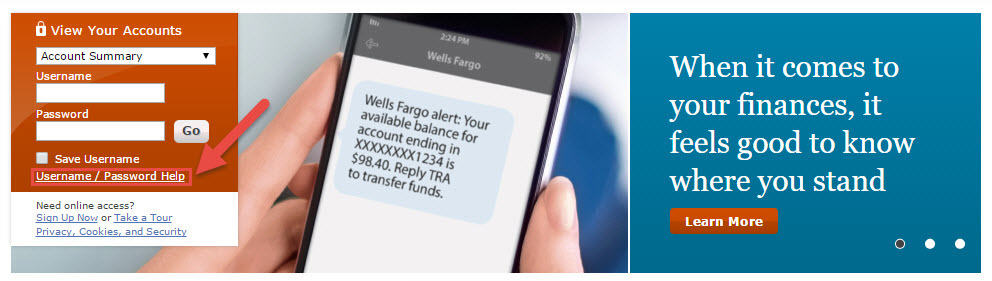

The bank deposits the bonus into the account within 10 business days of meeting the qualifications. Online Banking and Mobile Banking offer convenient methods to access your Wells Bank accounts. You can perform a variety of banking services online, whether by computer or other internet device. These free services include account information inquiry, statement retrieval, online transfers between accounts, online viewing of transactions and images of your checks, and online bill pay. Non-APY comparison conducted by an independent research firm and based on data compiled in May 2021 from company websites, customer service agents, and consumer savings account offers. In some cases, competitors assess and/or waive fees if certain criteria are met.

Wells Fargo has poor ratings on Trustpilot, where it has been rated 2.3 stars based on 78 reviews. Satisfied customers report a helpful customer support team, but these reviews are predominantly focused on Wells Fargo banking services. Negative reviews detail issues with customer support and getting approval for various financial products. That said, many of the negative reviews also are for other Wells Fargo services, like savings accounts and home loans. Current Wells Fargo customers can apply for a personal loan online or via telephone.

To do so, click "Apply now" from the personal loans homepage and provide the necessary information. If you don't already have an account with Wells Fargo, search for a local branch and meet with a banker to start your application. With a minimum opening deposit of $25, and direct deposits totaling $1,000 or more within the first 90 days, customers can earn $225 paid within 30 days.

There is no minimum balance requirement to earn the bonus. Customers must have direct deposits going into the account totaling $4,000 or more during the first 90 days the account is open. These can include payroll deposits, or Social Security or other government benefit payments.

The best part of this account is the low minimum deposit requirement—Wells Fargo only asks customers to deposit $25 to open the account. How much is it to start a bank account with Wells Fargo? You'll also discover ways to avoid fees and develop good money management habits, which will help you build a solid financial history. 1 $50 minimum opening deposit for Wells Fargo store and business banking locations. For Wells Fargo Phone BankSM or Wells Fargo Online® Banking the minimum opening deposit is $25.

For purposes of reporting Number of Employees, sole proprietors, self-employed individuals, and independent contractors should include themselves as employees (i.e., the minimum number in the box Number of Employees is one). Borrowers may use their average employment over the time period used to calculate their aggregate payroll costs to determine their number of employees. Alternatively, borrowers may elect to use the average number of employees per pay period in the 12 completed calendar months prior to the date of the loan application. Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations. Clover solutions made available through Wells Fargo Merchant Services, L.L.C. come with Clover Payments software that allows you to take payments through a web browser, mobile app, or your Clover device.

The cost of this software is included in the monthly service fee WFMS charges each month per account. Clover Station products will not work with the Clover Payments software alone, and require a more advanced software plan. Upgraded software plans, including those for Clover Station products, require an additional monthly fee per device, and will be billed directly from Clover. Availability of certain software plans, applications, or functionality may vary based on your selected Clover equipment, software, or industry.

On a second regulatory matter, Wells Fargo said late Thursday a 2016 consent order from the Consumer Financial Protection Bureau, or CFPB, regarding its retail sales practices has expired. The OCC also issued a Cease and Desist Order against the bank based on the bank's failure to establish an effective home lending loss mitigation program. The order requires the bank to take broad and comprehensive corrective actions to improve the execution, risk management, and oversight of the bank's loss mitigation program.

Wells Fargo reportedly does not allow co-signers on personal loans. However, prospective borrowers can apply for a loan with a co-applicant. This means that Wells Fargo considers both applicants' credit scores, incomes and outstanding debts.

Compared to co-signers, however, co-applicants have access to the loan funds and are responsible for making monthly payments. New customers who open a Chase Total Checking account and set up direct deposit to receive a bonus of $300 from the bank. This deal is not available to current Chase checking customers, those who have closed their accounts within 90 days, closed with a negative balance, or have fiduciary accounts.

Bankrate conducted a study of cash back promotions available on the market by surveying some of the biggest banks by deposits in the United States, based on Federal Deposit Insurance Corporation data. The following banks currently offer new customers cash incentives for opening a deposit account. Even though some of the these banks may be physically based in certain parts of the country, offers may be nationwide, as most require online applications. These offers are current as of February 2020, and are listed in no particular order.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.